Getting The Insolvency Practitioner To Work

Table of ContentsThe 10-Second Trick For Insolvency PractitionerThe Ultimate Guide To Insolvency PractitionerUnknown Facts About Insolvency PractitionerSome Known Incorrect Statements About Insolvency Practitioner Things about Insolvency PractitionerSee This Report on Insolvency PractitionerRumored Buzz on Insolvency Practitioner

Insolvency is when responsibilities are above the value of the company, or when a debtor can not pay the debts they owe. A company can become financially troubled as a result of a number of circumstances that lead to poor capital. When confronted with insolvency, an organization or individual can call creditors straight and restructure debts to pay them off.

Organization owners may contact lenders directly and restructure debts right into more convenient installments. Creditors are generally amenable to this method since they desire to be repaid and avoid losses, also if the settlement is on a postponed timetable.

The owner produces a proposal describing exactly how the financial obligation might be reorganized using price reductions or other plans for support. The proposition shows lenders how business may create enough cash money circulation for rewarding procedures while paying its financial debts. Normally, a forgiven debt might be taken into consideration income by the Irs (INTERNAL REVENUE SERVICE).

Not known Facts About Insolvency Practitioner

When a business has to pay enhanced prices for goods and solutions, the business passes along the price to the consumer. Instead of pay the raised expense, numerous consumers take their organization somewhere else so they can pay much less for a service or product. Losing clients results in shedding earnings for paying the business's financial institutions.

When procedures stop, so does the firm's earnings. Some business come to be financially troubled because their products or services do not progress to fit consumers' transforming requirements.

The Single Strategy To Use For Insolvency Practitioner

Expenditures exceed revenues and expenses remain unsettled. Cash-flow insolvency occurs when a company has the properties to cover their financial obligations but they are in the wrong type, such as actual estate instead of liquid funds. Balance-sheet bankruptcy, on the various other hand, shows a lack of assets in any type of kind to cover financial obligations.

The internal revenue service states that an individual is financially troubled when the total obligations exceed overall assets. Insolvency Practitioner. A insolvency, on the other hand, is an actual court order that depicts just how an insolvent individual or company will repay their creditors, or exactly how they will offer their possessions in order to make the payments

The smart Trick of Insolvency Practitioner That Nobody is Talking About

When a company or individual is insolvent, they can not satisfy their financial commitments. Bankruptcy is not the same as personal bankruptcy, although a firm that has come to be insolvent may submit for insolvency. Bankruptcy is the state of not being able to pay your commitments while insolvency navigate here is a legal procedure to release your financial debts.

Understanding the factors that can lead to insolvency, such as overspending, can help you stop bankruptcy and its effects.

The Only Guide to Insolvency Practitioner

It is popular that supervisors and policemans of firms (and managers of limited liability companies) owe fiduciary duties to their organizations and their investors (or participants). These fiduciary commitments are defined by state statutes and, though there are variants from state to state, they typically consist of a task of commitment and a task of treatment.

The obligation of care needs directors and officers to exercise persistance, to make educated decisions, and to act in good belief so that their actions are in the very best interest of the company. Past the range of this discussion, some states enable these responsibilities to be restricted either by so noting in the organizational files or abiding with various other requirements.

5 Easy Facts About Insolvency Practitioner Explained

Take care regarding offering shareholders preferential therapy at the expenditure of lenders (e.g., accrediting and moneying a dividend or a supply redemption). Be cautious concerning favoritism in between courses of shareholders. Make affordable initiatives to find out all the realities before taking a details course of activity; supervisors need to truly think that any choices made remain my explanation in the most effective passions of the corporation in its totality (i.e., decisions will be evaluated in hindsight in light of the result of such activities on the firm).

In any kind of personal bankruptcy or insolvency proceeding, payments made to specific lenders at the cost of various other creditors can be clawed back, specifically if there is some link in between the business and the creditor. Think about proposing at an annual shareholder conference (or any kind of various other meeting of stockholders) a resolution affirming that all previous service decisions and activities taken by the supervisors and officers of the company were absorbed great faith after a workout of affordable treatment.

Indicators on Insolvency Practitioner You Should Know

Totally reveal any personal or company relationships with parties on the other side of transactions entailing the firm to prevent the appearance of a dispute of passion. In examining potential fund elevating purchases or a sale of properties of the struggling corporation, be mindful that these transactions might be scrutinized later on due to any succeeding expansion of supervisors' fiduciary obligations to consist of creditors.

Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Melissa Joan Hart Then & Now!

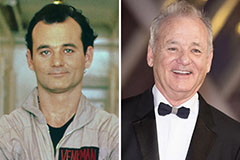

Melissa Joan Hart Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!